How would you get benefited by buying high dividend yielding stock and keeping it for long term?

Take a look of below live example:-

Stock Name : GUINNESS

Buy Price : $4.50

Buy Date : 20/10/2003

Closed Price As At 19/1/2007 : $6.10

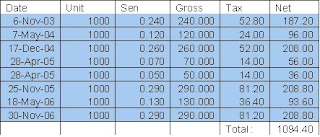

Dividend Payout Table :-

Take a look of below live example:-

Stock Name : GUINNESS

Buy Price : $4.50

Buy Date : 20/10/2003

Closed Price As At 19/1/2007 : $6.10

Dividend Payout Table :-

a) Share price appreciation

6.1 – 4.5 = 1.6

$1600.00

b) Total dividend earned

$1094.40

c) % return per annum

(a + b) / 4500 X 100 = 59.88%

59.88% / 3 = 19.96%

Total return per annum is about 19.96%.

So, if you ask me. I would say is worth keeping it but please have the below considerations as your stock criteria before selecting one:-

1) Must be consistently giving out dividend

2) Dividend payout must be at least 5% and above

3) Financially & fundamentally must be solid

4) Have a strategy on the stock picked (e.g averaging downward)

5) Picked a stock that never die/insolvent

6) Last but not least. Do your homework

No comments:

Post a Comment