My portfolio total gain increase from 76.5% to 81.3% last week. Very much thanks to PBBANK jump from 7.90 to 8.55. At this moment i will not increase my portfolio except for BJTOTO but again is very much depend on how the market will perform next week. I must reckon that is very risky to put your bet right now but when there is an opportunity i will certainly seize it.

Invest your money wisely to strive for financial independent. A slack hand causes poverty, but the hand of the diligent makes rich. (Proverbs 10:4)

Sunday, January 28, 2007

Saturday, January 27, 2007

BJTOTO (1562, RM4.64) is worth for a quick trade

My guts feeling this stock is worth for a quick trade, it hasn't move any compare to others blue chip stocks. The upside looks very bright, even if it were to turn south, there is always a dividend to cushion which will be paying somewhere around in April. Worth for a try.

Look at the chart above, high was at $4.98 on 30 Nov 2006 and drifting down after that. At this price should be quite reasonable to enter/accumulate. I would adopt a hit & run approach to ride on this "bull", probably with a higher load this time round as i must agreed the greed has succumbed me right now...he..he

Friday, January 26, 2007

BJTOTO - Another Typical Example

Another typical example on BJTOTO :-

Buy Price : $3.90

Buy Date : 19 Dec 2003

Closed Price as at 27 Jan 2007 : $4.64

B) Dividend earned + Capital Repayment

C) % return per year

Wah Oooo.... a 24.05% per year, what more do you want to ask for ?? Lets imagine this, if i spend $4 a week betting on 4-digits. One year i will be spending a total sum of $208 and losing it if luck was not on my site. What happen if i merely invest $4000 on BJTOTO and i got a return of 24% equivalent to $960 every year. Does this sound better to you ? This ensure you striking 4-digits every year. You risk your money betting on numbers, whereas I'm "betting" on company that invented the number games.......

Buy Price : $3.90

Buy Date : 19 Dec 2003

Closed Price as at 27 Jan 2007 : $4.64

A) Share price appreciation = 4.64 - 3.90 = 0.74

$740.00

B) Dividend earned + Capital Repayment

$2074.05

C) % return per year

(A + B)/3900 * 100 = 72.15%

72.15% / 3 = 24.05%

72.15% / 3 = 24.05%

Wah Oooo.... a 24.05% per year, what more do you want to ask for ?? Lets imagine this, if i spend $4 a week betting on 4-digits. One year i will be spending a total sum of $208 and losing it if luck was not on my site. What happen if i merely invest $4000 on BJTOTO and i got a return of 24% equivalent to $960 every year. Does this sound better to you ? This ensure you striking 4-digits every year. You risk your money betting on numbers, whereas I'm "betting" on company that invented the number games.......

Monday, January 22, 2007

Worth Keeping The Stock For Long Term ?

How would you get benefited by buying high dividend yielding stock and keeping it for long term?

Take a look of below live example:-

Stock Name : GUINNESS

Buy Price : $4.50

Buy Date : 20/10/2003

Closed Price As At 19/1/2007 : $6.10

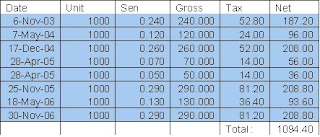

Dividend Payout Table :-

Take a look of below live example:-

Stock Name : GUINNESS

Buy Price : $4.50

Buy Date : 20/10/2003

Closed Price As At 19/1/2007 : $6.10

Dividend Payout Table :-

a) Share price appreciation

6.1 – 4.5 = 1.6

$1600.00

b) Total dividend earned

$1094.40

c) % return per annum

(a + b) / 4500 X 100 = 59.88%

59.88% / 3 = 19.96%

Total return per annum is about 19.96%.

So, if you ask me. I would say is worth keeping it but please have the below considerations as your stock criteria before selecting one:-

1) Must be consistently giving out dividend

2) Dividend payout must be at least 5% and above

3) Financially & fundamentally must be solid

4) Have a strategy on the stock picked (e.g averaging downward)

5) Picked a stock that never die/insolvent

6) Last but not least. Do your homework

Monday, January 15, 2007

Portfolio 15-Jan-2007

Ummmm.. This is my first ever portfolio in my blog of year 2007. Finally, i decide to publish it. Some of the stocks I have been keeping it since year 2002. Take a look, will update from time to time whenever there is a movement. I will try to post a more complete one when i have more time to compile one.

Wednesday, January 3, 2007

Financial Savvy - Rule 72

Financial Savvy

1) Rule 72

Definition :-

A simple formula to calculate number of years required for your investment to be doubled.

Example :-

An investment of $1000 with a return of 10 % interest rate.

72

--- = 7.2 years

10

The above scenario requires 7.2 years to double up your investment.

Averaging your investment towards financial freedom

Step 1 - How to save money

(sources from : Rajen Devadason)

“If you want to save more, then having your bank transfer a portion – say, 10% or 20% of your salary to a savings account the moment it hits your main account, is a great way to put saving on autopilot”

Step 2 – Invest intelligently

Concept of investing – when come to investing, an arithmetic anomaly can be harnessed to help build huge wealth over a span of 10, 20, or more years. Often, though not always, the lower the price of a security goes, the safer it is and the greater its value as a potential long term investment.

Step 3 – Investment strategy - DCA

Should meet 6 criteria investment asset before a DCA program is embarked on :-

i) diligence

ii) value of the investment should fluctuate over time

iii) investment time frame should be fairly long. ( 5 to 7 years )

iv) invest at regular intervals (1 a month, 1 a quarter or 1 a year)

v) invest at each of those intervals in equal amount

vi) these regular investments should continue through all kind of market conditions – good, bad and indifferent

Example :-

Let’s say you have $6000 to invest. You have 3 choices :-

a) you do nothing significant & keep money in FD earning 4% a year.

b) You invest full sum into a unit trust or a security

c) You gradually invest $6000 for 12 months.

Conclusion :-

Choice a) $240 earned as interest.

Choice b) 6% earned base on the DCA table. An equivalent of $360.

Choice c),

How DCA works

1) Rule 72

Definition :-

A simple formula to calculate number of years required for your investment to be doubled.

Example :-

An investment of $1000 with a return of 10 % interest rate.

72

--- = 7.2 years

10

The above scenario requires 7.2 years to double up your investment.

Averaging your investment towards financial freedom

Step 1 - How to save money

(sources from : Rajen Devadason)

“If you want to save more, then having your bank transfer a portion – say, 10% or 20% of your salary to a savings account the moment it hits your main account, is a great way to put saving on autopilot”

Step 2 – Invest intelligently

Concept of investing – when come to investing, an arithmetic anomaly can be harnessed to help build huge wealth over a span of 10, 20, or more years. Often, though not always, the lower the price of a security goes, the safer it is and the greater its value as a potential long term investment.

Step 3 – Investment strategy - DCA

Should meet 6 criteria investment asset before a DCA program is embarked on :-

i) diligence

ii) value of the investment should fluctuate over time

iii) investment time frame should be fairly long. ( 5 to 7 years )

iv) invest at regular intervals (1 a month, 1 a quarter or 1 a year)

v) invest at each of those intervals in equal amount

vi) these regular investments should continue through all kind of market conditions – good, bad and indifferent

Example :-

Let’s say you have $6000 to invest. You have 3 choices :-

a) you do nothing significant & keep money in FD earning 4% a year.

b) You invest full sum into a unit trust or a security

c) You gradually invest $6000 for 12 months.

Conclusion :-

Choice a) $240 earned as interest.

Choice b) 6% earned base on the DCA table. An equivalent of $360.

Choice c),

How DCA works

Arithmetic average price = 5.72 / 12 = 0.4767 per unit

True average cost = 6000 / 12633.88 = 0.4749 per unit

Absolute profit = $695.96

Profit percentage gain = 11.6%

Remarks : I have personally tried this on one of the high dividend yielding stock “APOLLO” and it works. Of course the returns are never guaranteed. Nonetheless, I believe doing so could be the smartest resolution you make. The choice is yours. TQ

Subscribe to:

Comments (Atom)