Underscoring their defensive characteristics, earnings results for 1Q2011 for the two largest real estate investment trusts (REIT) on the local bourse were broadly in line with market expectations. No major surprises.

CMMT cmpletes first post-listing acquisition

CapitaMalls Malaysia Trust (CMMT) — the second largest REIT on the local bourse by market capitalisation — has just completed its first property acquisition since its debut on Bursa Malaysia in July 2010. The purchase of Gurney Plaza Extension was finalised at end-March 2011 — and its contributions will be reflected in the current quarter’s results and beyond.

To recap, the new acquisition is a nine-storey retail extension block adjoining the Gurney Plaza mall in Penang with a RM215 million price tag and added almost 140,000 sq ft of net lettable area (NLA) to CMMT’s portfolio of assets under management. That is equivalent to an area expansion of roughly 7.5% and raised its total NLA to just over two million sq ft.

To part finance the acquisition, some 144.9 million new units were issued — at RM1.06 per unit — enlarging the total units in circulation to 1,494.9 million. At the prevailing unit price of RM1.16, CMMT has a market capitalisation of more than RM1.73 billion. The REIT has a relatively large free float of about 58%.

As of end-March, CMMT has investment properties valued at a combined RM2.37 billion and total assets of almost RM2.5 billion. Its book value stood at RM1.03 per unit.

CMMT’s 1Q11 earnings results were broadly in line with expectations. Revenue totalled some RM52.7 million while net profit was reported at RM31.4 million, including fair value gain of RM5.7 million for the revaluation of Gurney Plaza Extension. Revenue contribution was more or less evenly distributed among the three properties in its portfolio, Gurney Plaza, Sungei Wang Plaza and The Mines.

As mentioned above, earnings in the upcoming quarters will be boosted by the latest acquisition — as well as better rental rates. Lease renewals in 1Q11 for all three properties saw upward rental revisions, averaging some 7.6%. Meanwhile, occupancy rates stayed high across the board, at an average of about 98.7% in 1Q11.

CMMT is on track to meeting its forecast income distribution of 7.46 sen per unit for the current year. As stated in the prospectus, the trust intends to distribute all of its income this year and at least 90% of income going forward. The first distribution of 1.74 sen per unit has already been made just prior to the completion of acquisition of Gurney Plaza Extension and the issuance of the new units.

Assuming total income distribution of 7.46 sen per unit, investors will earn a yield of 6.4% at the current price. That is a fairly attractive return given its low-risk profile and it is well above prevailing bank deposit rates.

Sunway REIT yield estimated at 6.1%

Similarly, Sunway REIT is confident of hitting its earnings forecast for the current financial year ending June 2011. At the unit price of RM1.10, it is currently the largest listed real estate investment trust on the local bourse, with a market capitalisation of more than RM2.95 billion. Its free float is estimated at roughly 62%, which gives investors pretty good liquidity.

The trust reported revenue and income available for distribution totalling RM240.1 million and RM133.2 million in the first nine months of FY11, respectively, including surplus cash from 50% of manager’s fees paid in units. Net assets per unit stood at 97 sen as at end-March 2011.

Its retail assets fared slightly better than forecast on the back of continued growth in mall visitorship, near full occupancy and upward revision in rental rates. The flagship Sunway Pyramid Shopping Mall, which contributed to more than 61% of total net property income, has an average occupancy of 98.5% for 9MFY11. It achieved a 16.5% (for a three-year term) growth in rental for leases renewed so far this financial year, which accounted for nearly 69% of the mall’s total NLA.

On the other hand, contributions from the hospitality arm, including the Sunway Resort Hotel & Spa and Pyramid Tower Hotel, were below expectations in the latest 3QFY11. This was attributed to lower tourist arrivals due, in part, to cancellations from Japanese corporates following the earthquake and resulting tsunami disasters in the country. Nonetheless, earnings for the nine-month period remain on track to meeting management’s forecast for the year.

Elsewhere, earnings from office properties were resilient. Occupancy at Sunway Tower averaged a high 97% in the financial year to date while the Menara Sunway is fully occupied.

For the full year, total income distribution is estimated at 6.74 sen per unit, which will earn investors a yield of 6.1% at the prevailing price of RM1.10.

The trust intends to distribute to unit holders 100% of net earnings in the first two years of listing and a minimum of 90% annual profits thereafter.

Some RM87.4 million of the available income for distribution, or about 3.26 sen per unit, has already been paid. Sunway REIT will trade ex-entitlement for the third round of distribution, of 1.7 sen per unit, on 16th May.

As with CMMT, Sunway REIT too has just completed its first acquisition post-listing. The purchase of Putra Place for RM514 million was finalised in April 2011, after its winning bid at a public auction. The acquisition will boost the combined value of its investment properties to over RM4.2 billion. (Note that there is currently a legal dispute involving the purchase with Metroplex, but the trust believes that the former’s claims are unlikely to be successful).

The newly acquired property comprises The Mall (an 8-level shopping complex), 100 Putra Place (office tower), and 5-star hotel, The Legend, including its serviced apartments, penthouses and parking bays.

With strong sponsors, we expect both REITs will continue to expand their portfolios of assets going forward.

Sunway REIT has been granted a right of first refusal on Sunway City’s properties. The latter is the single largest unit holder in the trust and is one of the largest property developers in the country.

Meanwhile, CMMT has a right of first refusal for CapitaMalls Asia’s retail properties in Malaysia. The latter is its biggest stakeholder and a subsidiary of Singapore-listed CapitaLand. It is also a leading integrated shopping mall owner, developer and manager in the region, with some 91 retail properties worth a collective S$23.7 billion (RM57.5 billion) in Singapore, China, Japan, Malaysia and India.

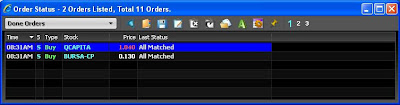

Nevertheless, is a record high so far for my trading. If this can be consistently and persistently maintained for few more months, then, a steady income would be able to continue. Though, i hope for a regular income but my target set very low, 10% yearly profit would be enough but i guess i have surpassed this figure over 4 times now.

Nevertheless, is a record high so far for my trading. If this can be consistently and persistently maintained for few more months, then, a steady income would be able to continue. Though, i hope for a regular income but my target set very low, 10% yearly profit would be enough but i guess i have surpassed this figure over 4 times now.