Invest your money wisely to strive for financial independent. A slack hand causes poverty, but the hand of the diligent makes rich. (Proverbs 10:4)

Friday, April 24, 2009

Scalp on SAAG

Did a quick scalp on SAAG when seeing the opportunity by buying at RM0.24 and disposing them in stages up. Making some quick bucks for weekend money.

Sold All My Maybulk

Just sold off all my Maybulk this morning at RM3.02 after ex-date of 30sen dividend. The reason of selling is simple, i expect EPS for year 2009 to fall and might expect a lower net dividend payout for Maybulk after a generous 30sen div. Thus, trigger my selling idea for now. Will keep monitor this counter until there is clearer earning expected before getting it back.

Meanwhile take a look of it financial summary below:-

Meanwhile take a look of it financial summary below:-

Thursday, April 16, 2009

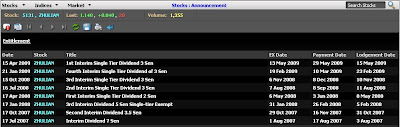

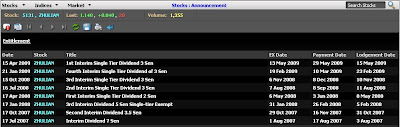

Sold Half of Zhulian at RM1.14

Manage to dispose half of my holding on ZHULIAN. ZHULIAN has just declared a 1st interim ST dividend of 3sen. ZHULIAN has been giving out dividend on every quarter without failed. Annual % return on div is about 10% based on current price at 1.14. Long term hold and beating FD rate of 3% is anytime from ZHULIAN.....

Take a look of its div payout so far....

Take a look of its div payout so far....

Wednesday, April 15, 2009

Wednesday, April 8, 2009

More Investors Say Bye-Bye to Buy-and-Hold

Interesting Article, hng, for your reading pleasure.....

By JANE J. KIM

For much of the past decade, Kenneth Kimmons of Bedford, Texas, was a buy-and-hold investor. He regularly socked away money in mutual funds across his 401(k) plans, individual retirement accounts and a brokerage account.

But after watching his investments fall by about 50% last year, he started trading individual stocks and options full-time last fall. He generally buys stocks at the start of the trading day -- lately, it's been bank stocks -- and sells them a few hours later. "I just got tired of putting money away and losing it," says the 31-year-old. He says he's doubled his money since he started trading full-time.

The ups and downs of the market are prompting more retail investors to abandon buy-and-hold strategies in favor of opportunistic trading. Some want more control over their money, so they are fleeing funds and advisers -- not to mention the feelings of helplessness raised by recent months' losses. Some are attempting to recoup their losses, while others are stepping back into the markets after a recent string of stock gains and better-than-expected economic news.

Most financial advisers still believe investors should stay the course, pointing out that frequent trading can incur fees, erode returns and result in higher tax bills. But many individuals have lost faith in the long-term growth of their investments and are trying to make money off the market's volatility.

"When I was younger, I banked on the fact that, over time, stocks will go up, and that if you dollar-cost average [following a fixed schedule of purchases], you'll be fine," says Jim Catalano of Ashburn, Va., who in September rolled over money from an old 401(k) into an IRA at TradeKing, an online brokerage firm with low trading fees. "But my time horizon is getting shorter -- and when you see your 401(k) get chopped in half, I decided I needed to take the reins here and not leave it to the money managers."

Mr. Catalano trades mostly stocks and exchange-traded funds, usually four to five times a week. He writes covered-call option contracts to generate income off his shares, a tactic that could lose him some of the upside if share prices rise substantially. Since he started trading in September, he is down about 5% but has done better than the market.

At the New York Stock Exchange and Nasdaq stock exchanges, turnover levels -- a measure of how often the average share changes hands -- have been rising. At the same time, stock-fund investors sold about 33% of their holdings last year, implying a three-year average holding period, down from a four-year holding period in 2004, according to the Bogle Financial Markets Research Center.

Discount brokerage firms -- including Charles Schwab Corp., TD Ameritrade Holding Corp., E*Trade Financial Corp., ING Groep NV's Sharebuilder and Fidelity Investments -- are seeing record levels of trading activity and new-account openings. Since last September, nearly 7.5 million investors -- or 20% of the online investing community -- have increased trading volume enough to be temporarily reclassified at a higher trading level, says Matthew Bienfang, senior research director at TowerGroup.

More Investors Ramp Up Trading

More buy-and-hold investors are changing tactics. Here are some factors to consider:

Trading activity and new account openings are hitting highs as average holding periods decline.More investors are trying to take advantage of market volatility, which they expect to continue.Active trading can erode returns as investors get hit with higher trading costs and taxes."Typically in a bear market, you'll see a retraction of activity and reduction of people opening new accounts," says Jay Pestrichelli, managing director at TD Ameritrade. "This time around, somebody forgot to tell the retail client that's what happens."

Some market experts say retail investors are likely to make a bad situation even worse. "It's a fools' game," says John Bogle, the 79-year-old founder of mutual-fund giant Vanguard Group, which helped popularize index funds and the virtues of buy-and-hold investing. Not only will short-term investors pay more commissions, fees and other costs, but various studies have shown that market timers typically lose more money than buy-and-hold investors. "If you want to trade the market, you've got to be right twice -- you've got to get out and get back in," he says.

But others say things are different this time. "The problem I have with the buy-and-hold strategy is that it's a bull-market strategy," say Matthew Tuttle, a financial adviser in Stamford, Conn. "In the bust, you give all of your profits back." Mr. Tuttle has recently taken a more active approach to trading. While short-term investors are likely to face higher tax bills -- since short-term gains are taxed at higher rates than long-term gains -- he notes that some people who incurred big losses last year will be able to carry those losses forward to offset taxes in future years.

"The psychology of the market is broken," says Michael Parness, who runs Trendfund.com, which dispenses trading advice online. "People just don't trust it." As a result, many of the market's moves are "almost entirely based on whatever news is coming out of the government," he says.

The uncertain environment has prompted David Dilley of Bonita Springs, Fla., to trade more frequently. The 76-year-old retiree believes there has been a "sea change" in economic philosophy -- shifting from private enterprise to a command-and-control economy. "The long-term market gains that we've had in the past will not occur until that reverts and we get back free enterprise," he says. So, while he had considered himself a longtime buy-and-hold investor, he's now trading Canadian oil trusts in his E*Trade account several times a week. Mr. Dilley didn't provide exact numbers but says he's beating the broader market averages so far this year.

In another sign that investors are getting more speculative, the most widely held stocks in investors' accounts at discount brokerage firms Sharebuilder, TradeKing and Firstrade Securities Inc. are the same ones that are under the most pressure, including Citigroup Inc., American International Group Inc., Ford Motor Co., General Electric Co., and Bank of America Corp. By contrast, the most popular stocks a year ago were Apple Inc., Google Inc., Microsoft Corp. and the like.

"We see a lot of people trying to ride the waves of stocks with no long-term vision," says TradeKing Chief Executive Don Montanaro. "They're so low-priced -- and it's nothing for these stocks to move 40% or 50% in a week."

Sue Cirillo of Pelham Manor, N.Y., used to hold on to household names such as Apple. But last fall, she sold some of her longtime holdings, moved to cash and started trading. "The difference between now and then is that when I've made money, I take it off the table and look for the next opportunity," says the 47-year-old music producer. "Before, I was more focused on companies that I felt were going to be profitable." Now, she pays attention to daily market swings, subscribes to online advice services such as Mr. Parness's for trading ideas, and has recently learned to short stocks.

Mark Swenson of southern New Hampshire says he typically trades with exchange-traded funds, instead of buying individual stocks. The 40-year-old says he started trading for the first time last October, in part to generate additional income in case his work as a plumber dried up. Although he says he got "slaughtered" when he first started trading, he says that he has since made up much of that initial loss and that it's easier for him to trade than do nothing.

"I could no longer stomach it -- watching my money disappear," he says. "For right now, it's a traders' market. Until I get the sense that the market is on the rise, I generally don't plan on doing any buying and holding -- not for the long term."

Others got tired of paying their advisers. Last June, Linda Smith of Denver fired her broker, saying it was a waste of money to pay her adviser 1.5% in annual fees for picking mutual funds she believed she could pick herself. "No one on this planet knows better what to do with my finances than me," says the 53-year-old.

For the year, she figures her portfolio is up about 5%, including the interest from her CDs. "Nobody can time the market 100% correctly 100% of the time," she says. "However, that doesn't mean you can't get lucky now and then."

By JANE J. KIM

For much of the past decade, Kenneth Kimmons of Bedford, Texas, was a buy-and-hold investor. He regularly socked away money in mutual funds across his 401(k) plans, individual retirement accounts and a brokerage account.

But after watching his investments fall by about 50% last year, he started trading individual stocks and options full-time last fall. He generally buys stocks at the start of the trading day -- lately, it's been bank stocks -- and sells them a few hours later. "I just got tired of putting money away and losing it," says the 31-year-old. He says he's doubled his money since he started trading full-time.

The ups and downs of the market are prompting more retail investors to abandon buy-and-hold strategies in favor of opportunistic trading. Some want more control over their money, so they are fleeing funds and advisers -- not to mention the feelings of helplessness raised by recent months' losses. Some are attempting to recoup their losses, while others are stepping back into the markets after a recent string of stock gains and better-than-expected economic news.

Most financial advisers still believe investors should stay the course, pointing out that frequent trading can incur fees, erode returns and result in higher tax bills. But many individuals have lost faith in the long-term growth of their investments and are trying to make money off the market's volatility.

"When I was younger, I banked on the fact that, over time, stocks will go up, and that if you dollar-cost average [following a fixed schedule of purchases], you'll be fine," says Jim Catalano of Ashburn, Va., who in September rolled over money from an old 401(k) into an IRA at TradeKing, an online brokerage firm with low trading fees. "But my time horizon is getting shorter -- and when you see your 401(k) get chopped in half, I decided I needed to take the reins here and not leave it to the money managers."

Mr. Catalano trades mostly stocks and exchange-traded funds, usually four to five times a week. He writes covered-call option contracts to generate income off his shares, a tactic that could lose him some of the upside if share prices rise substantially. Since he started trading in September, he is down about 5% but has done better than the market.

At the New York Stock Exchange and Nasdaq stock exchanges, turnover levels -- a measure of how often the average share changes hands -- have been rising. At the same time, stock-fund investors sold about 33% of their holdings last year, implying a three-year average holding period, down from a four-year holding period in 2004, according to the Bogle Financial Markets Research Center.

Discount brokerage firms -- including Charles Schwab Corp., TD Ameritrade Holding Corp., E*Trade Financial Corp., ING Groep NV's Sharebuilder and Fidelity Investments -- are seeing record levels of trading activity and new-account openings. Since last September, nearly 7.5 million investors -- or 20% of the online investing community -- have increased trading volume enough to be temporarily reclassified at a higher trading level, says Matthew Bienfang, senior research director at TowerGroup.

More Investors Ramp Up Trading

More buy-and-hold investors are changing tactics. Here are some factors to consider:

Trading activity and new account openings are hitting highs as average holding periods decline.More investors are trying to take advantage of market volatility, which they expect to continue.Active trading can erode returns as investors get hit with higher trading costs and taxes."Typically in a bear market, you'll see a retraction of activity and reduction of people opening new accounts," says Jay Pestrichelli, managing director at TD Ameritrade. "This time around, somebody forgot to tell the retail client that's what happens."

Some market experts say retail investors are likely to make a bad situation even worse. "It's a fools' game," says John Bogle, the 79-year-old founder of mutual-fund giant Vanguard Group, which helped popularize index funds and the virtues of buy-and-hold investing. Not only will short-term investors pay more commissions, fees and other costs, but various studies have shown that market timers typically lose more money than buy-and-hold investors. "If you want to trade the market, you've got to be right twice -- you've got to get out and get back in," he says.

But others say things are different this time. "The problem I have with the buy-and-hold strategy is that it's a bull-market strategy," say Matthew Tuttle, a financial adviser in Stamford, Conn. "In the bust, you give all of your profits back." Mr. Tuttle has recently taken a more active approach to trading. While short-term investors are likely to face higher tax bills -- since short-term gains are taxed at higher rates than long-term gains -- he notes that some people who incurred big losses last year will be able to carry those losses forward to offset taxes in future years.

"The psychology of the market is broken," says Michael Parness, who runs Trendfund.com, which dispenses trading advice online. "People just don't trust it." As a result, many of the market's moves are "almost entirely based on whatever news is coming out of the government," he says.

The uncertain environment has prompted David Dilley of Bonita Springs, Fla., to trade more frequently. The 76-year-old retiree believes there has been a "sea change" in economic philosophy -- shifting from private enterprise to a command-and-control economy. "The long-term market gains that we've had in the past will not occur until that reverts and we get back free enterprise," he says. So, while he had considered himself a longtime buy-and-hold investor, he's now trading Canadian oil trusts in his E*Trade account several times a week. Mr. Dilley didn't provide exact numbers but says he's beating the broader market averages so far this year.

In another sign that investors are getting more speculative, the most widely held stocks in investors' accounts at discount brokerage firms Sharebuilder, TradeKing and Firstrade Securities Inc. are the same ones that are under the most pressure, including Citigroup Inc., American International Group Inc., Ford Motor Co., General Electric Co., and Bank of America Corp. By contrast, the most popular stocks a year ago were Apple Inc., Google Inc., Microsoft Corp. and the like.

"We see a lot of people trying to ride the waves of stocks with no long-term vision," says TradeKing Chief Executive Don Montanaro. "They're so low-priced -- and it's nothing for these stocks to move 40% or 50% in a week."

Sue Cirillo of Pelham Manor, N.Y., used to hold on to household names such as Apple. But last fall, she sold some of her longtime holdings, moved to cash and started trading. "The difference between now and then is that when I've made money, I take it off the table and look for the next opportunity," says the 47-year-old music producer. "Before, I was more focused on companies that I felt were going to be profitable." Now, she pays attention to daily market swings, subscribes to online advice services such as Mr. Parness's for trading ideas, and has recently learned to short stocks.

Mark Swenson of southern New Hampshire says he typically trades with exchange-traded funds, instead of buying individual stocks. The 40-year-old says he started trading for the first time last October, in part to generate additional income in case his work as a plumber dried up. Although he says he got "slaughtered" when he first started trading, he says that he has since made up much of that initial loss and that it's easier for him to trade than do nothing.

"I could no longer stomach it -- watching my money disappear," he says. "For right now, it's a traders' market. Until I get the sense that the market is on the rise, I generally don't plan on doing any buying and holding -- not for the long term."

Others got tired of paying their advisers. Last June, Linda Smith of Denver fired her broker, saying it was a waste of money to pay her adviser 1.5% in annual fees for picking mutual funds she believed she could pick herself. "No one on this planet knows better what to do with my finances than me," says the 53-year-old.

For the year, she figures her portfolio is up about 5%, including the interest from her CDs. "Nobody can time the market 100% correctly 100% of the time," she says. "However, that doesn't mean you can't get lucky now and then."

Subscribe to:

Comments (Atom)