Invest your money wisely to strive for financial independent. A slack hand causes poverty, but the hand of the diligent makes rich. (Proverbs 10:4)

Monday, December 31, 2007

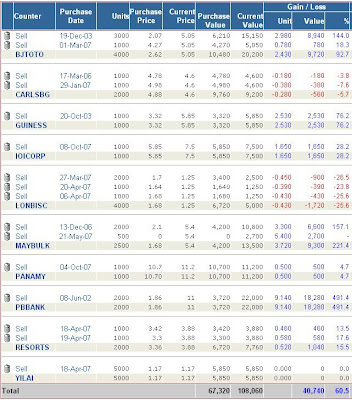

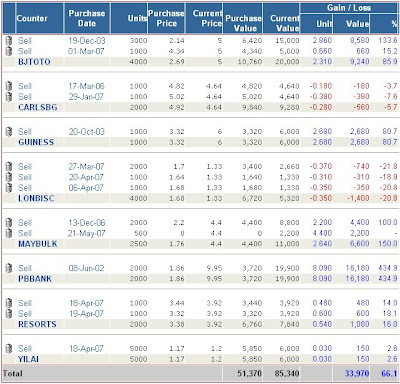

Monthly Portfolio 31-December-2007

Sunday, December 30, 2007

Thursday, December 27, 2007

Net Dividend Collected

Friday, December 21, 2007

Remisier Versus Online Trading

Remisier versus online trading

In this article, we will look into whether we should buy shares online or use our existing remisier’s services to execute trade

COMMISSION rates for Internet trading and cash upfront transactions will be fully negotiable next year.

Although the full details on the actual implementation are not available yet, if the commission on Internet trading drops to a low of 0.15% (it may be even lower for some stockbroking firms), retailers may be tempted to execute the online transactions themselves without going through their remisiers.

Based on the existing structure, most retailers are paying a brokerage fee of about 0.6% per transaction. Assuming some stockbroking companies are willing to offer commission rates of 0.15% for Internet trading, there will be savings of 0.45% for retailers who trade online.

Nevertheless, we need to understand that transaction costs have two main components: explicit cost and implicit cost.

Explicit cost is the direct cost of trading, such as brokerage commission, stamp duties and clearing fees. Implicit costs are indirect trading costs like opportunity cost, market impact and missed trade costs.

Opportunity cost is the loss of opportunities due to the time retailers are required to spend on executing stock transactions instead of focusing on their main business or their work.

If you are working and have limited time to monitor the stock market, you may still need the remisier’s services to execute stock transactions.

I personally feel that it is really not productive to stay in front of the computer just to execute a few stock transactions. Sometimes, it can be quite time consuming getting the best price.

Any retailer who wants to trade online needs the necessary skills to be able to read market movements. He needs to know whether the current price is the best price to buy, or wait for a while because he may get a cheaper price later.

Market impact is the realised profit or loss reflecting the price movement of a share from the price decided on to the execution price.

Since remisiers follow market movements throughout the day, they should be able to read those movements better than we do.

They may not be able to get the best price in every trade but if they are able to save one or two bids lower than your intended purchase price, the cost saving can be quite substantial.

For example, your remisier is able to get one bid lower for you when you want to purchase a stock priced at RM1.50. You will save 1 sen over RM1.50, which is 0.67%.

Assuming your remisier is able to do that in eight out of 10 trades, the average cost saving will be 0.53% (8/10 x 0.67%).

This saving will still be greater than the commission of 0.45% that you would have saved through online trading.

Besides, you have not taken into consideration the time you could have saved and the opportunity loss on your current business if you spend too much time on share trading. The extra 0.45% that you pay is for your remisier’s skills.

As mentioned earlier, besides opportunity costs and market impact, there are other implicit trading costs, like missed trade costs.

Missed trade costs arise from the failure to execute a trade in a timely manner.

If you split a purchase of 20 lots of Stock A into two equal limit orders when the quote for Stock A is RM11.00 to RM11.10, the first order is executed at the buying price of RM11.00, after which the quotation moves up to RM11.10 to RM11.20.

The second order is placed and executed at RM11.10. You are paying an additional 10 sen (or 0.9%) for the remaining 10 lots.

Missed trade will cost you an additional 0.45% (0.5 x 0.9%) as 50% of your remaining stocks were traded at a price that was 0.9% higher.

A good remisier should be able to save you the above implicit costs. In this competitive business environment, remisiers need to continue upgrading their skills in order to give better services to their clients.

Friday, December 7, 2007

How Much is this affecting you with minimum $40 brokerage Fee Next Year?

Scenario 1 :- Buying penny stock…..

a) Purchase value 1,000 units @ $1 = 1000.00

b) Brokerage @ 0.42% = 4.20 but minimum is 40.00

c) Clearing Fee @ 0.03% = 0.30

d) Stamp Duty @ 1.00/1000 = 1.00

Total Purchase Cost = 1041.30

You need 9 sen to breakeven, coz, buy + sell will cost you about 82+…..

Compare to old calculation, total purchase cost for above scenario will cost you 1013.30

You need 3 sen to breakeven, your buy+sell is relatively much smaller, about 26+…..

Scenario 2 :- Buying Big Cap…..

a) Purchase value 1,000 units @ $10 = 10000.00

b) Brokerage @ 0.42% = 42.00

c) Clearing Fee @ 0.03% = 0.30

d) Stamp Duty @ 1.00/1000 = 10.00

Total Purchase Cost = 10055.00

You need 12 sen to breakeven, coz, buy + sell will cost you about 110+…..

No change with old calculation as the minimum brokerage ($40) is fully utilized.

So folk, in order to fully utilize your brokerage fee, government is encourage you to buy more instead. Will this affect small timers the most ?? Currently with 9 sen up we can afford to have a profit but with the introduction of minimum $40 charge this 9 sen in turn become your breakeven point unless of course if you can afford to buy in bulk then is a difference scenario. This is bad, imagine, the current lot size is 1 lot = 100 units, if someone thrown 100 units share to you out of the 10,000 units you queued. You will be suffering with minimum of 80+ charge with the mere 100units share that you acquired. I can see that there is no point of buying small on penny stock now because the gain is just too insignificant for one to expect and the gain may just well serve as a subsidy for the brokerage fee unless a jackpot was hit that the counter just rocket high. Thus, folk stay big from now onward, there isn’t much place for small anymore.

Thursday, November 29, 2007

Monthly Portfolio 29-November-2007

Tuesday, November 20, 2007

Dividend Yielding Stocks - PBBANK, PANAMY, MNRB, GUINNESS, BJTOTO & APOLLO

Listed below are some of the high dividend yielding stocks. These stocks have been consistantly paying good dividend without failed. Some DY is as high as 10% based on current price, one can just investing in this type of counter to profit the dividend and still much better off than putting the money in FD for a mere 3.7%.

PBBANK - Dividend Yielding 6%

APOLLO - DIvidend Yielding 8%

Sunday, November 11, 2007

EKSONS & LHH

Alicafe, below is for you, hope it help. Obviously you can see LHH is on the uptrend and EKSONS is on the downtrend. There is saying "buy on support and sell at resistance" but is all depend whether the trend is up swing or down swing. Take your judge carefully. Determine the S&R is important as it will help you to execute your trades more accurately.

Disclaimer: The above don't recommend a Buy/Sell. Make your own judgement and be responsible to your own act.Monday, October 29, 2007

Monthly Portfolio 29-October-2007

Wednesday, October 10, 2007

5077-MAYBULK MALAYSIAN BULK CARRIERS BHD

Article Entitled: "Buoyant rates to lift MBC profit"

We refer to the query by Bursa Malaysia Securities Berhad vide its letter dated

6 September 2007, in relation to a news article appearing in The New Straits

Times, Biznews section, page 40 on Thursday, 6 September 2007 and in particular

the following statements:

"MALAYSIAN Bulk Carriers Berhad (MBC) ... said its net profit this year could

rise as much as 17 per cent...."

"... full-year profit could reach between RM360 million and RM365 million...."

In response to the above query, Mr Kuok Khoon Kuan did not give percentage nor

did he give any comparison between the 2006 and expected 2007 performance.

However, as quoted in the Financial Daily of 6th September 2007, Mr Kuok

disclosed that “There is no let up or signs that it (the shipping industry) is

going south-bound anytime soon. For the second half of 2007, the Baltic Dry

Index (“BDI”) has been going up, so there is no doubt that the performance will

be equally strong.”

Mr Kuok commented that in view of the strong drybulk market as indicated by the

BDI, if profit before tax (PBT) for first half 2007 was extrapolated, then the

full year PBT would be about RM360 million to RM365 million.

We wish to clarify that the quoted figures were not intended to refer to any

financial estimate, forecast or projection of our Group.

Monday, October 1, 2007

Public Bank set to sustain record

By ELAINE ANG

PUBLIC Bank Bhd (PBB) has the distinction of being one of the most favoured banking stocks of the investment fraternity – churning out solid earnings each financial year and lining shareholders' pockets with fat dividends.

Its asset quality is the best in the industry with net non-performing loans ratio standing at 1.5% as at end-June. This has not compromised loans growth, which has been sustaining at double-digits for some years.

The bank's prudence has also stood it in good stead, as it was not affected by the US subprime crisis.

The banking group's excellent performance has been recognised industry-wide bagging it many awards throughout the years, enough to fill a trophy cabinet and more.

Tan Sri Teh Hong PiowSuch an outstanding track record raises the question of whether PBB's performance is sustainable in an increasingly competitive industry thus putting much pressure on the banking group to continue to perform.

Chairman and founder Tan Sri Teh Hong Piow is unfazed and is confident PBB would not disappoint its shareholders.

“We intend to sustain our track record of delivering financial performance, enhancing shareholder value and rewarding shareholders with strong dividend policy.

“This will be underpinned by continued adherence to good corporate governance and transparency.

“We also see ourselves as providing more cutting edge, innovative and superior products and services supported by a well-trained and motivated sales team,” he told StarBiz.

Teh's vision is for PBB to remain the premier bank – to be in the forefront of the Malaysian banking industry while expanding its regional presence particularly in the Asia-Pacific region.

“We believe in doing what we do best. Going forward, we will be driving our non-interest income by widening our suite of products and services. We intend to intensify our wealth management business,” he said.

One avenue is via Public Mutual Bhd. Presently, 22.6% of its fund is invested in the fast growing Asia-Pacific region, and 1.2% invested in Europe and the US.

Teh expects Public Mutual to make further inroads to increase its market share backed by its strong distribution network and excellent fund performance track record.

“We will continue to be on the lookout for synergistic opportunities. In this light, we will be forging strategic alliances with the best in their own industries.

“We are in the midst of finalising a tie-up with a global insurance company to customise bancassurance products as unique propositions to our customers,” he said.

As part of its plan to expand its regional presence, PBB has aggressively expanded its branch network since it acquired Asia Commercial Bank Ltd (ACB) in May last year.

ACB was subsequently renamed Public Bank (Hong Kong) Ltd.

The total number of branches has almost doubled to 24 from 13, with 22 branches in Hong Kong and two branches in Shenzhen, China.

“This expansion programme will be continued to enhance our market reach.

“We will also leverage on the existing 40 branches of Public Finance Ltd to cross-sell the bank’s products and services,” Teh said.

He added that PBB was also building its resources especially the sales force to aggressively penetrate the Chinese market to grow its loans.

This was particularly in retail lending with emphasis on consumer financing such as personal loans, motor vehicle financing and mortgage financing.

It will also focus on lending to middle market commercial businesses, particularly to small- and medium-sized enterprises.

Looking ahead, PBB will continue to strengthen its overseas operations in Indochina and look into the feasibility of providing a wider range of financial products.

This would be in in addition to the conventional loans and deposits.

Teh said Indochina was a relatively untapped market with good potential to develop the financial and insurance services.

CampuBank Lonpac, a joint venture between CampuBank, PBB and LPI Insurance Bhd commenced business operations on Aug 30 offering the full suite of general insurance products.

“We are very happy with the volume of business garnered so far in this short period of less than one month.

“Currently, there are no plans for any mergers and acquisitions.

“However, we are always open to financial-related business opportunities which have earnings sustainability and the potential to increase shareholder value,” Teh said.

As OSK Research banking analyst Chan Ken Yew puts it: “PBB is not a sexy stock. It is a bit boring like any low beta (risk) stock.

“It grows slowly but very steadily and investors like it as a dividend cum growth stock.

“I can comfortably say that the group should continue to sustain its performance for the next two to three years at least.

“Its aggressive expansion overseas in Hong Kong, China and Indochina should also help boost the group's future financials.”

Saturday, September 29, 2007

Monthly Portfolio 29-September-2007

There isn't any movement on my portfolio, still holding my same old stocks. Has been quite lazy lately to post anything here. My focus has been diverted to Forex lately and still generating profit slowly & steadily. Below is my portfolio for the month of September, till then happy trading. Sayonara...

Friday, September 7, 2007

Dry-bulk shipping rates reach new highs

PETALING JAYA: The Baltic Dry Index (BDI) crossed the psychological 8,000-point level, closing at a new high of 8,090 on Wednesday.

With the latest surge in the index, the BDI, which measures commodity shipping costs of various routes and ship sizes, has averaged 6,950 so far in the current quarter, 16% higher than the average 5,983 in the second quarter this year.

The average in the current quarter is 93% higher than the average 3,593 in the corresponding quarter last year.

A Bloomberg report quoted China Cosco Holdings Co chairman Wei Jiafu as saying yesterday that shipping rates for dry-bulk cargo, such as iron ore and coal, would continue to rise as China's economy would see robust growth for the next 20 years.

In another report, Bloomberg quoted China Ocean Shipping (Group) Co deputy director of research and development Yang Shicheng as saying that China would import 390 million tonnes of iron ore this year, 11% more than last year.

That would hold freight rates at record highs, he said, adding that iron ore would remain the key driver of freight rates, having replaced grain since the start of the century.

AmResearch said in an update report yesterday that dry-bulk charter rates set all-time highs again last week, with average Capesize spot charter rates ending the week at close to US$125,000 a day, while the average Panamax spot charter rates finished at over US$62,000 a day.

Capesize refers to ships that are too large to pass through the Suez Canal and Panama Canal, and which have to go around the Cape of Good Hope or Cape Horn. Panamax refers to ships that are too big to go through Panama Canal.

AmResearch cited a media report that an aluminium smelter would be put up in Sarawak by a joint venture between Rio Tinto and Cahya Mata Sarawak Bhd.

“We view this news as positive to our bulk universe, both for the long haul (Maybulk) and feeder services (Hubline).

“Hubline will have first mover advantage due to its stronghold in resource-rich Sarawak, and with the expected delivery of two handysize vessels by 2009, Hubline will be running a total of 26 bulk vessels,” AmResearch said.

Handysize is the most widely used type of dry-bulk vessel and are between 15,000 and 50,000 tonnes deadweight in size.

Thursday, August 30, 2007

Monthly Portfolio 28-August-2007

Thursday, August 16, 2007

Public Bank not exposed to US subprime mortgage market

"The Public Bank group's overall operations, including its Labuan Offshore Bank and overseas operations in Hong Kong and China, Indochina and Sri Lanka have absolutely no exposure to the US subprime mortgage market segment whether directly or indirectly in its investment portfolio," he said in a statement.

The unit trust funds managed by Public Mutual also do not have any direct or indirect investment in the US subprime mortgage market.

Teh expects the group's loans growth to be sustained at the annualised rate of 17% as achieved in the first half of the year.

"The group's customer deposits continue to grow strongly. Asset quality is expected to remain strong.

"Currently, the group's net non-performing loan ratio is only 1.5% – the lowest in the banking industry in Malaysia.

"With its healthy loan to deposit ratio of 75%, the group is very liquid," he said.

Saturday, July 28, 2007

Monthly Portfolio 28-July-2007

Saturday, July 21, 2007

Resorts World begins share-buyback

Resorts World begins share-buyback

By KATHY FONG

PETALING JAYA: Resorts World Bhd kick-started its capital management plan with the commencement of its share-buyback scheme yesterday.

This came after the group had in a surprise move sold a 14% stake in loss-making Star Cruises Ltd last Friday for RM1.16bil cash.

Resorts World announced to Bursa Malaysia it bought back nine million shares at an average price of about RM4.15 a share, costing it RM37.36mil. The stock closed at RM4.22 yesterday, up 32 sen.

This is the first time that Resorts World has bought back its own shares.

Genting Bhd’s head of strategic investments and corporate affairs Justin Leong said: “As Resorts World’s largest shareholder, we are pleased that Resorts World has finally embarked on its capital management programme.

“We see this as a positive step towards enhancing value for all shareholders.”

In the past, there was criticism that Resorts World’s capital management was not efficient enough, given its large idle cash reserves.

Resort World’s cash pile is nearly RM2bil now and is expected to balloon to RM4bil by year-end.

Saturday, June 30, 2007

Monthly Portfolio 30-June-2007

Wednesday, June 20, 2007

Trendlines for Novice

Friday, June 15, 2007

How to define Support & Resistance on Stock for New Traders - Novice

SUPPORT - is where the buying at a price lever is strong enough to cause a reverse in a downtrend.

RESISTANCE - is where the selling at a price lever is strong enough to cause a reserve of an uptrend.

Most of the traders look for support levels when they wish to buy and they similarly look for resistance lever when they wish to sell.

Saturday, June 9, 2007

Trading Stocks Is A Long Haul Thing

Thursday, June 7, 2007

Congratulations to our PM

Wednesday, June 6, 2007

Saturday, May 26, 2007

Monthly Portfolio 26-May-2007

Thursday, May 24, 2007

Whose fault is it ??

Saturday, May 12, 2007

Magnum may unveil big special dividend

A source said the company, subject to board approval at a meeting on Tuesday, could announce a special dividend of between 60 and 70 sen a share.

The board may give the go-ahead for the numbers forecast operator (NFO) to distribute its vast cash pile of more than RM700mil.

Last year, Magnum raised its dividend to 14 sen a share from 10 sen. The return of cash will benefit shareholders and none more greatly than Multi-Purpose Holdings Bhd (MPHB), which owns 51% of Magnum.

The cash from Magnum may help MPHB pare down debt but the source said MPHB also had a good story to tell.

MPHB, the source said, was set to announce a record profit for its first quarter ended March 31, thanks to Magnum's strong NFO business and a robust stockbroking business owing to the bull run on Bursa Malaysia.

MPHB announced a pre-tax profit of RM86.4mil and a net profit of RM60.5mil, or 6.3 sen a share, for its fourth quarter.

Saturday, May 5, 2007

Which high cap stock will replace Maxis on KLCI?

Below was extracted from The Star for you reading pleasure :-

PETALING JAYA: The Kuala Lumpur Composite Index (KLCI) is going to miss some significant members with Maxis Communications Bhd on its way out of Bursa Malaysia alongside Island & Peninsular Bhd (I&P) and Malakoff Bhd, which are also being taken private by their respective owners.

|

The three companies have a combined capitalisation of close to RM50bil, representing almost 7% of the benchmark's total market capitalisation (market cap) based on yesterday's closing prices.

Maxis closed RM2.30 higher at RM15.30 while I&P and Malakoff were unchanged at RM2.33 and RM10.30 respectively.

Earlier this week, business tycoon T. Ananda Krishnan made a 20% premium offer of RM15.60 per share to take full control of Maxis.

Last week, Permodalan Nasional Bhd announced plans to take I&P private by buying the remaining shares it does not own for RM2.35 each.

Malakoff, on the other hand, will be delisted at the end of this month on completion of the sale of its assets to parent MMC Corp Bhd.

A fund manager noted that the liquidity in these counters would have to be distributed elsewhere. “It means more money will be going into other index-linked counters,” he said.

While the funds could move to new entrants to the benchmark index, there were not many blue chips that were not already part of the KLCI, the fund manager added.

Bursa Malaysia chief executive officer Datuk Yusli Mohamed Yusoff said in an e-mail reply to StarBiz that the exchange would implement “a standard process'' to replace any index-linked stocks that had been de-listed.

“The number of index constituents in the KLCI is fixed at 100. The weightage of each constituent is distributed by way of market cap, with bigger companies assuming higher weightage,” he added.

A head of research at a local brokerage said: “Ultimately it depends on how Bursa wants to replace the companies. The new entrants don't have to be of similar size to those that are being dropped.''

He said based on sectors, YTL Power Bhd could represent the power industry and Green Packet Bhd the telecommunication sector.

Other potential candidates were Nestle (M) Bhd, Dutch Lady Milk Industries Bhd and JT International Bhd, the research head said.

“Liquidity and free float could be an issue. But there are stocks on the KLCI currently which are low in liquidity.

“Market capitalisation is probably one of the biggest single factors,'' added Pong Teng Siew, head of research at MIMB Investment Bank.

Saturday, April 28, 2007

Monthly Portfolio 28-April-2007

Wednesday, April 25, 2007

Good Article - What triggers a downfall in the market?

AS a result of China's higher-than-expected economic growth of 11.1% and fear of possible further interest rate hikes in China, regional markets, including Malaysia, fell sharply last Thursday.

This was the second time after Chinese New Year (CNY) that a drop in Chinese stock prices rattled the markets across Asia.

According to Lee In Ho in his study on Market Crashes and Informational Avalanches, there are four stages in a market crash. They are boom, euphoria, trigger and panic.

Under the boom stage, the market will normally have a main theme that excites everyone about stocks.

In Malaysia, several positive measures under the Ninth Ma- laysia Plan got investors excited about the construction and property sectors. At this stage, this is seldom a bubble as companies continue showing good corporate results. A bubble will be created at the euphoria stage. The unjustified extrapolation of future earnings and the revision of higher target prices by research analysts can cause overconfidence in companies’ future performance.

A bubble will start to take shape when the general public reacts to this overconfidence. An irrational exuberance will occur when market prices and expectations about future values are far beyond the fundamentals of the companies.

However, no one will know when the rise will stop. A market will resume its upward trend until something triggers the downfall.

Usually, the stock prices get higher and steeper just before the market crash.

At the trigger stage, private information will reach a threshold that triggers other traders to alter their behaviour. At this critical situation, when almost everyone is at irrational exuberance, any event can trigger the market to tumble.

In January 1994, our stock market put the blame on former finance minister Tun Daim Zainuddin for saying that he had sold all his shares because prices had reached dangerous levels.

Until now, nobody can really understand the main reason behind the sharp plunge on the Shanghai Index right after the CNY.

According to some fund managers in China, the selling was mainly due to investors panicking when they noticed that their friends were selling stocks.

A famous researcher in behavioural finance, Robert Shiller, conducted a survey by asking institutional and individual investors what was in their mind during the stock market crash in 1987. One conclusion he drew was that the crash was due to people reacting to each other with heightened attention and emotion.

Investors seemed to follow what other investors were doing. As a result of action and reaction, a feedback loop was created when everyone had a simultaneous reaction to common stimuli.

A market crash is described as a process that corrects a public belief that is inconsistent with the current distribution of private information. The severity of a crash will depend on whether the market is filled by “new generation” investors or experienced traders.

“New generation” investors do not know anything about the stock market but are greedy and want to get quick money from it. A market will not crash if it has experienced traders who know how to control risk and when to cut losses.

However, if a market is filled by “new generation” investors with no holding power and do not know when is the right time to sell a stock, any sharp drop in prices could result in panic selling. At this panic stage, the fear of further drops could cause big fall in prices.

When will the stock market crash again?

My usual answer for this question is the stock market will not crash as long as you continue to worry about when it will crash. The market will crash at the time when you least expect it to happen. Investors should remember that the market always performs beyond your expectations.

We should not be too worried about when the market will crash. Instead, we should consistently review our portfolio and sell those stocks whose prices have gone beyond their intrinsic value.

Sunday, April 22, 2007

Saturday, April 21, 2007

Reveals the high dividend yielding stocks

Below is the compiled list of all high dividend yielding stocks. Those in light green are my preference at the moment. Take a look you may find your preferred stocks here. Bear in mind that these companies might not pay the same amount of dividend as they used to be, is very much depend on the company performance & result that lead them for consistent dividend payout.

Tuesday, April 17, 2007

Thursday, April 12, 2007

More companies raising dividend

By YEOW POOI LING (Source : The Star 12 April 2007)

PETALING JAYA: High dividend yield stocks will provide support amid lingering concerns of market correction or weakening in the US economy.

OSK Investment Bank head of research Kenny Yee said dividend stocks helped “mitigate volatility in the portfolio” as they were more stable in terms of share price movement.

He noted that more and more companies were raising their dividend to reward shareholders.

“Companies realise that paying good dividends helps boost the share price as well as increase efficiency in capital management,” he said, adding that it also improved return on equity.

For example, Public Bank Bhd declared a total dividend of 60 sen per share for the year ended Dec 31, 2006. Since the dividend’s ex-date on March 16, the share price has appreciated 5.7% to RM9.20 yesterday, giving a total return of RM1.10 per share or total shareholders’ return of 12.6%.

Meanwhile, MIMB Investment Bank head of research Pong Teng Siew said during a market rally, investors tended to look for capital gain, hence stocks with attractive dividend yield only attracted “a certain type of investors.”

“Usually in a bull run like now, investors buy for capital gain and not for stable income because they do not want to risk under-performing the market,” Pong added.

Companies that had a stable recurring income would be able to sustain paying out high dividends, he said, citing examples like Chemical Co of Malaysia Bhd, Bintulu Port Holdings Bhd and Highlands & Lowlands Bhd.

Sunday, April 1, 2007

Monthly Portfolio 30-March-2007

Saturday, March 24, 2007

KLCI - 23rd March 2007

Tuesday, March 20, 2007

BJTOTO (1562, RM4.72) Something Fishy ?

With the active shares buyback the price has inched further and even breakout from the price that I set for at $4.74 today. Hence, the upside possibility is high if nothing suspicious arouse. The next level that the price may head to is $4.90. RSI +, MACD crossed over & price are heading north, thus, at this moment would recommend a trading buy on this counter.

Saturday, March 17, 2007

KLCI - 16th March 2007

Sunday, March 11, 2007

KLCI - 9th March 2007

Sunday, March 4, 2007

Portfolio 04-March-2007

Saturday, March 3, 2007

KLCI - 3th March 2007

26/2/2007 -- 1272.87 (-10.6)

27/2/2007 -- 1237.08 (-35.79)

28/2/2007 -- 1196.45 (-40.63)1/3/2007 -- 1180.91 (-15.54)

2/3/2007 -- 1164.68 (-16.23)

Needless to say, no matter how good was your recommendations are. It all turn out to be otherwise, that's no doubt about it. The question is will the KLCI find it footing and recover next week?? I am negetive to it. However this create chance for us to grab some quality stocks which we may have missed out earlier. The market have been bullish since last July 2006, it is time for a dip though this may have been affected by the overall worldwide market down turn. In every situation there is an opportunity, so find it and seize it. May the best price be yours.

Sunday, February 25, 2007

Buying List/Ideas

Stock Name : SILVER (7136, RM0.53)

Recommendation : BUY

Stock Name : NEXTNAT (0096, RM0.675)

Recommendation : BUY

Stock Name : MAYBULK (5077, RM3.48)

Recommendation : BUY

Stock Name : GOODWAY (7192, RM0.78)

Recommendation : BUY

Stock Name : EKOWOOD (5091, RM0.94)

Recommendation : BUY

Saturday, February 24, 2007

CARLSBG (2836, RM5.50)

One should not expect much on Carlsberg as this is the nature of this share all this while. I doubt the result will have any great impact on share price in fact it might surge further if it able to break through the resistant price at RM5.60 (refer to chart). Carlsberg is currently on the uptrend & always remain for dividend play in my portfolio and I would recommend HOLD on this stock.

Saturday, February 10, 2007

PBBANK (1295, RM9.00)

Sunday, February 4, 2007

Portfolio 04-Feb-2007

Sunday, January 28, 2007

Portfolio 28-Jan-2007

Saturday, January 27, 2007

BJTOTO (1562, RM4.64) is worth for a quick trade

Look at the chart above, high was at $4.98 on 30 Nov 2006 and drifting down after that. At this price should be quite reasonable to enter/accumulate. I would adopt a hit & run approach to ride on this "bull", probably with a higher load this time round as i must agreed the greed has succumbed me right now...he..he

Friday, January 26, 2007

BJTOTO - Another Typical Example

Buy Price : $3.90

Buy Date : 19 Dec 2003

Closed Price as at 27 Jan 2007 : $4.64

B) Dividend earned + Capital Repayment

C) % return per year

72.15% / 3 = 24.05%

Wah Oooo.... a 24.05% per year, what more do you want to ask for ?? Lets imagine this, if i spend $4 a week betting on 4-digits. One year i will be spending a total sum of $208 and losing it if luck was not on my site. What happen if i merely invest $4000 on BJTOTO and i got a return of 24% equivalent to $960 every year. Does this sound better to you ? This ensure you striking 4-digits every year. You risk your money betting on numbers, whereas I'm "betting" on company that invented the number games.......