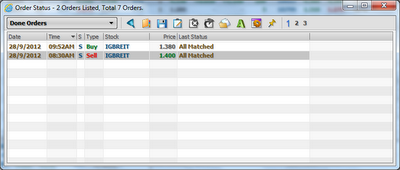

1. IGBREIT - Sold all of them at RM1.40 and bought them back at RM1.38. 2sen profit. ^^

2. ASTRO - Tomorrow will be the last day of IPO application, will try very small units on this.

3. I do hope market is steady starting next week.

4. HEKTAR - Will be receiving my subscribed units on 2/10/2012 and i hope to be given excess as well no matter big or small. ^^

5. Watch List - IGBREIT, HEKTAR, IJM, APOLLO, CARLSBG, GLOMAC

6. Good Luck all.

44 comments:

Horse,Hng,Teng

I am eyeing 3A as it is now pretty cheap. Appreciate your knowledge re it's fundamentals .

Thanks in advance.

Alwayswin111

Sorry,totally new to 3A company. Are they making A4 paper?

Teng

Three-A Resources Berhad (3A) is an investment holding company. Through its subsidiary, San Soon Seng Food Industries Sdn. Bhd. (SSSFI), 3A is engaged in manufacturing and selling of food and beverage ingredients. SSSFI's products are caramel colors, glucose syrups, soya protein sauces, natural fermented vinegars, distilled vinegars, rice vinegars, caramel powders, hydrolyzed vegetable protein (HVP) powders, soya sauce powders and maltodextrins. The Company operates in Hong Kong, China, South Korea, Singapore, Indonesia, Philippines, Australia and United States of America. The Company's Three-A Food Industries (M) Sdn. Bhd. Is an investment holding company. The Company's activities are predominantly in the manufacturing industry segment. Kerry Investment Co. Ltd., a 98.39% owned subsidiary of Wilmar International Limited, to incorporate a 50:50 joint venture company, Three-A (Qinghuangdao) Food Industries Co. Ltd.

I think Robert Kuok bought into the company few years back around the time he got out of the sugar business in Malaysia .

Hng

Wah your IJM .... Huat ... Loh.... good for you

Hng

But if unable to go above 4.80, not so good ya?

3A makes food additive, they have JV factory in china next to wilmar soybean crushing plant. Wilmar JV with them as they are the largest soybean crusher in china, and 3A uses the leftovers for the HVP. 3A is one of the largest HVP producers in the asian region. Although their plant is recently up and running, the high cost of soybean is putting a dent in their profits.Also Wilmar recorded loss on their soybean crushing operations as well. So margins will take time to recover. Good company, decent margin, niche product just need to time the turnaround. :)

3A is also trading at 6% DY bit with PE of 25...even a good company is hard to justify the PE, and since growth is slower than expected, the prices has fall over 30% in the past year.

Sorry should be 1.2% DY for 3A.. wrong calculation...

Bought Faber at 1.28

alwayswin111

Still keep all IJM, looking for RM5.00 target price.

Teng

Dijacor -OR follow previous Bjcrop-OR, trade at lowest and yet no one dare to buy in

Hng

If Dijacorp trade below 1,their RI maybe undersubscribed.

Teng

100% underspecified like what happen in bjcorp. But, major shareholder may take opportunity to increase their stake at the expense to other shareholder at cheap entry price

alwaywin111

IJM may have potential follow kulim recovery path, slump and recover

WCT-WB is now trading 1% premium.. hmm... for 6 month expiry...

Hng

Thanks.

Gark

Thanks for info.

Technically 3A has a gap support at 0.97-0.945 and a Fibonacci 61.8% support at 0.915. Am watching these levels. Volume is miserable.. ...

Gark

Wait for discount or negative premium.

Hng

Are you looking at IGB?I bought 2 batches at 2.21 and 2.25.Sold some at 2.31. Now seems it is below 2.3 again. Not sure to sell or keep?

Teng

IGB, yes miss it when it down to 2.21, will keep watch to buy on weakness.

Hng

Almost everyday IGB has share buyback but share still down last 2 weeks. I got IGB last week when chitchat with CK online.we talk about IGBreit and I was mad not able to get UGBreit at 1.37. So switch to IGB

gark

WCT mother up another 2 cts,and WB maintain or drop 0.5-1 cent,premium will be zero or negative

Teng

The more safer level to enter IGB will be around 2.00-2.10, which i think is hard rock bottom line already.

Teng

You will have pretty of time to enter IGBREITS once kassest ex for its entitlement to distribute IGBREITs to its shareholder, Liquidity will greatly increase

Hope UEMland can stay above 1.70 today

hi guys, just a question. Glomac-Wa exercise price at 0.550 conversion 1:1. Currently its trading at 0.23 and mother is at 0.805.

So 0.23+0.550= 0.780 only?

Means still profit of 0.25 if l;ets say today it ends?

Hng

True.Once Kasset shareholder received IGBReits,more people may sell

Hng

You sold all your UOADev?I sold half last friday at 159

Teng

Already sold off UOAdev last week, now wait for UEMland to perform shows

Hng

UEMLand >170 . Good profit for you

Teng

I hope next turn will be Faber, already hit hard rock bottom, wait for rebound soon

You all think YTL right worth to buy??

trading on 3rd october 2012.

details: http://ck5354.blogspot.com/2012/10/ytl-right-trading-date.html

Hng

Follow you to buy Faber at 1.28

sold all IGB at 232. realise profit first

Also sold UOADev at 161.

Luck is not with me. Sold IGB and UOA,both counter go up

Hng-Bring me some luck esp on Faber

Teng

With Budget out, and MOH granted 15% increment in budget, Faber should be able to secure extension by now with higher charges and wider service coverage. Alternatively, IHH with larger cap could launched takeover on Faber to complement its exiting healthcare service

Teng

Your UOAdev continue up, Congratulate, laughing all the way to bank :)

Faber by OSK 10 August report

Faber’s 1HFY12 net profit made up 47% and 56% of our and consensus’ FY12

forecasts. The numbers matched our estimates as we anticipated a stronger

showing in 2HFY12, especially from its property division. We maintain our

forecast and Trading Buy recommendation, at an unchanged FV of RM2.34, based

on a 10% discount to our SOP valuation. Despite the prolonged delay in renewing

its hospital support services (HSS) concession, we hold firm to our view that a

renewal is forthcoming given Faber’s vast experience and good track record.

Teng

Never mind lah, so long continue making profit, 'sikit sikit lama lama menjadi BUKIT'

Hng

Yes,make money also complain.

Look forward to make more money

ck5354

Faber should have limited downside risk indeed, our patience will be payout soon.

worst come to worst trade as dividend stock.

Q4 estimated 8 cents,

so based on 1.28, it will be 6.25% yield.

ck5354

Faber is also cash rich company, paying higher than 8sen dividend no problem at all. Look forward at least 10sen dividend

Teng

You can buyback IGB already to make contra gain

Bought more Faber at 1.28

Post a Comment